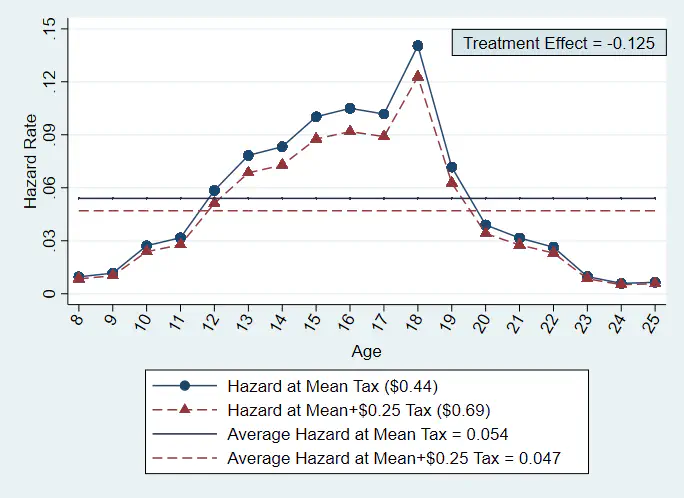

This paper explores the role of social interactions on a youth’s decision to begin smoking. Specifically, we estimate the effect of cigarette taxes during early childhood on beginning smoking later in adolescence in a discrete-time hazard model. These taxes do not directly affect children but may change the prevalence of smoking among parents, older relatives, or other adults. We find that a $0.25 cigarette tax increase during childhood decreases smoking initiation by 12.5 percent. Our results suggest that parents and older siblings do not account for the entire indirect effect, so other members of the community also likely play a role. Prior work understates the total effect of cigarette taxes by not considering this indirect channel.